A flexible approach to U.S. growth and income investing

Fundamental Investors®

INCEPTION DATE

August 01, 1978

IMPLEMENTATION

Consider for a large-cap core allocation

OBJECTIVE

The fund’s investment objective is to achieve long-term growth of capital and income

VEHICLE

Fundamental Investors

Fundamental Investors investment professionals use in-depth, bottom-up research to identify undervalued companies with attractive appreciation potential.

INVESTING IN GROWTH

Identifying the companies powering growth

Fundamental Investors makes investments in the companies powering economic growth and developing new products and services. Our investment professionals seek to identify overlooked companies with attractive prospects for capital appreciation, including those outside of traditional industries.

IDENTIFYING LONG-TERM LEADERS IN A BROAD RANGE OF SECTORS

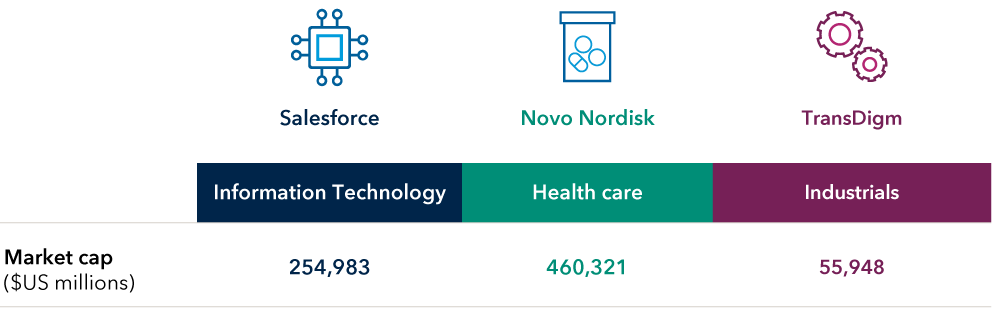

Examples of top holdings in the portfolio (as of December 31, 2023)*

Investment thesis

Salesforce

- A U.S.-based technology services company that engages in the design and development of cloud-based enterprise software for customer relationship management.

- The company has benefited from improved capital allocations.

- Led by a strong management team that is known for positive execution, embarking on an attractive artificial intelligence opportunity.

Novo Nordisk

- A Denmark-based global biopharmaceutical firm that is the world’s largest insulin manufacturer and leader in new classes of injectable and oral anti-diabetic and obesity drugs (GLP1s).

- With over 450 million diabetics and 650 million clinically obese people worldwide, Novo appears well positioned for this opportunity over the long-term.

- Novo Nordisk appears in a position of financial strength due to its strong balance sheet, one of the highest margins in the pharmaceuticals industry, a 26-year track record of raising its dividend and forwardlooking double-digit top- and bottom-line growth projected in 2024.

TransDigm

- A U.S.-based aerospace & defense supplier that engages in the design, production and supply of aircraft components.

- As travel demand continues to grow, TransDigm is in a position of strength as one of the world’s leaders in supplying commercial aftermarket and OEM parts to the industry.

- Strong management teams and operating cultures that have helped create sustainable pricing power.

*Companies shown are among the top 20 holdings by weight in Fundamental Investors as of 12/31/23 (Broadcom, Microsoft, Alphabet, Meta Platforms, Philip Morris International, TransDigm Group, UnitedHealth Group, Novo Nordisk, Amazon, Salesforce, Eli Lilly, Visa, TSMC, Applied Materials, Apple, Micron Technology, Carrier Global, Canadian Natural Resources, Dollar Tree Stores, Centene).

Sources: FactSet, Capital Group, and Morningstar. As of December 31, 2023.