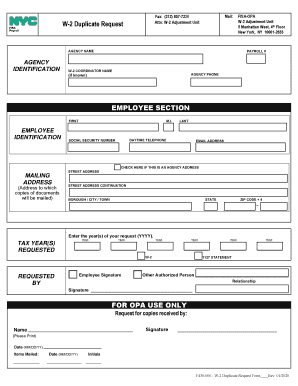

NY W-2 Duplicate/ Correction Request Form free printable template

Show details

THE CITY OF NEW YORK ... W-2 Adjustment Unit ... NYC.gov/payroll ... A fee of $5 is charged for each copy of a W-2 or 1127 more ... FOR OPA USE ONLY.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

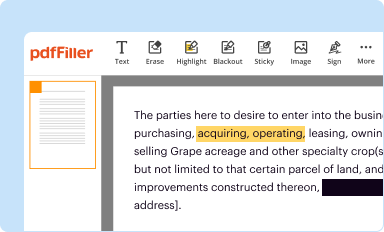

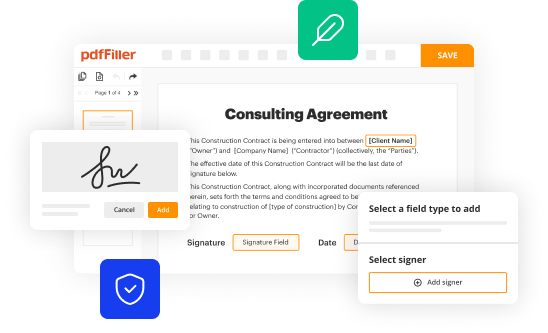

Edit your w 2 duplicate request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w 2 duplicate request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w 2 duplicate request online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit w 2 duplicate request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NY W-2 Duplicate/ Correction Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out w 2 duplicate request

How to fill out W-2 duplicate request:

01

Obtain a copy of the W-2 form from your employer or payroll department.

02

Fill in your personal information accurately, including your name, Social Security number, and contact information.

03

Provide complete and correct information about your employer, including the employer's name, address, and Employer Identification Number (EIN).

04

Enter the details of your wages and tax withholdings in the appropriate boxes. This information should match the figures on your original W-2 form.

05

Double-check all the information you have entered to ensure it is accurate and complete.

06

Sign and date the W-2 duplicate request form.

07

Submit the completed form to the appropriate entity, such as the Internal Revenue Service (IRS) or your state tax agency, as per their instructions.

Who needs W-2 duplicate request:

01

Individuals who have lost or misplaced their original W-2 form may need to request a duplicate copy.

02

Employees who have not received their W-2 form from their employer by the designated deadline may require a duplicate request.

03

If your original W-2 form contains inaccuracies or errors, you may need to request a duplicate W-2 form with the correct information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is w 2 duplicate request?

A W-2 duplicate request is a request made by an individual to obtain a duplicate copy of their W-2 form. The W-2 form is a document provided by an employer to an employee, which reports the employee's annual wages and the amount of taxes withheld from their paycheck for a specific tax year. If the original W-2 form is lost, damaged, or never received, an individual may need to request a duplicate copy from their employer or the Internal Revenue Service (IRS) in order to accurately file their taxes.

Who is required to file w 2 duplicate request?

The employer is required to file a W-2 duplicate request with the Social Security Administration (SSA) when a copy of an employee's W-2 form has been lost, stolen, or destroyed.

How to fill out w 2 duplicate request?

To fill out a W-2 duplicate request, follow these steps:

1. Obtain Form 4506: You will need to obtain Form 4506, Request for Copy of Tax Return, from the Internal Revenue Service (IRS) website or by calling the IRS forms hotline.

2. Fill out the form: Provide your personal information, including your name, Social Security number, address, and the tax year for which you need the duplicate W-2.

3. Verify your identity: If you are mailing the form, you need to attach a copy of your identification document, such as a passport or driver's license. If you are submitting the request online, the IRS will verify your identity electronically.

4. Provide the employer's details: Enter the details of the employer from whom you need a duplicate W-2. This includes the employer's name, address, and Employer Identification Number (EIN). If you cannot recall the EIN, try to find it on your last pay stub or contact your employer.

5. Specify the number of copies: Indicate the number of duplicate W-2 copies you need.

6. Sign the form: Sign and date the form to certify that the information provided is accurate.

7. Submit the form: If you are mailing the form, send it to the address provided on the Form 4506 instructions. If you are submitting online, follow the instructions on the IRS website to complete your request.

Note: The process may vary depending on your specific circumstances, so it is always advisable to consult the IRS website or contact a tax professional for assistance.

What is the purpose of w 2 duplicate request?

The purpose of a W-2 duplicate request is to obtain a copy of the W-2 form for a specific year that was originally issued by an employer. This may be necessary if the original W-2 is lost, misplaced, or never received. The duplicate form is needed for various reasons, such as filing tax returns, verifying income, applying for loans, or resolving any discrepancies with the IRS.

What information must be reported on w 2 duplicate request?

When requesting a duplicate W-2, you may need to provide the following information:

1. Your personal information: Full name, address, and Social Security number.

2. Employer information: Name, address, and Employer Identification Number (EIN) of the company or organization you worked for.

3. Employment details: The dates you were employed by the company and your job title.

4. Reason for requesting duplicate: You may need to provide a reason for why you need a duplicate W-2.

5. Signature: Your request may require your signature to authorize the release of the duplicate W-2.

Additionally, it is recommended to keep any proof of communication or receipts related to the request, such as emails or confirmation numbers, for future reference.

What is the penalty for the late filing of w 2 duplicate request?

The penalty for the late filing of a W-2 duplicate request can vary depending on the specific circumstances and the discretion of the Internal Revenue Service (IRS). Generally, if a taxpayer fails to file a timely W-2 duplicate request, they may be subject to penalties and interest on any taxes owed. It is recommended to file the request as soon as possible to minimize the potential penalties.

How can I send w 2 duplicate request for eSignature?

When you're ready to share your w 2 duplicate request, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute w 2 duplicate request online?

Easy online w 2 duplicate request completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit w 2 duplicate request on an iOS device?

Use the pdfFiller mobile app to create, edit, and share w 2 duplicate request from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your w 2 duplicate request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.